Chennai | September 2025: India’s consumption story received a fresh boost from two key factors – simplification of GST slabs and above-normal monsoon rains. These developments are seen raising rural incomes, supporting household savings, and driving demand for both essentials and discretionary goods. This, in turn, is likely to further boost investor interest in consumption-themed mutual funds.

“India’s consumption remains a structural growth story, anchored by rising incomes, favourable demographics, and aspirational demand,” said Chandraprakash Padiyar, Senior Fund Manager, Tata Asset Management. “The government’s move to rationalise GST, coupled with good monsoon, is set to drive major tailwinds for consumption-led sectors. At Tata AMC, our portfolios are positioned with a higher concentration in select consumption opportunities compared to broader indices, ensuring we remain aligned with India’s evolving consumption landscape.”

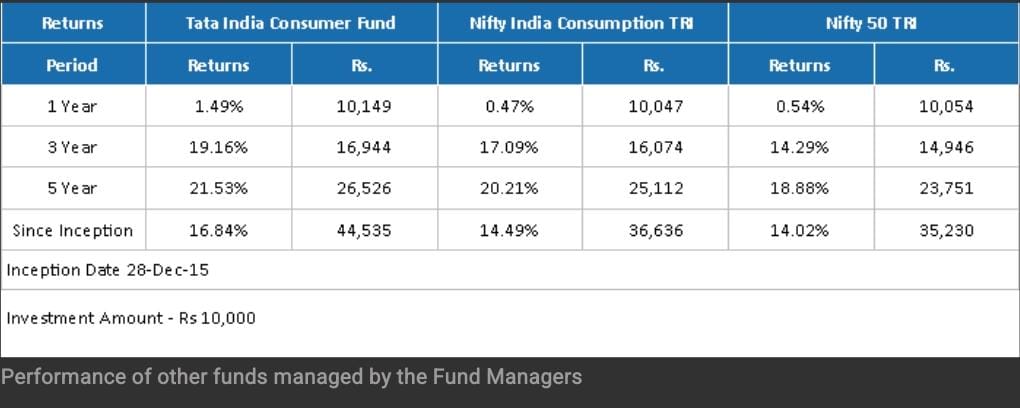

The Tata India Consumer Fund has delivered approximately 19% returns over three years, compared to 17% return by its benchmark Nifty India Consumption Index (TRI). The fund has given about 21% returns over two years, vis-à-vis the 20% return by the benchmark (Source: Value Research). Investors’ interest reflects in the fund’s rising traction, as total gross inflows touched Rs 256.2 crore in 2025 (till August), up 17% from Rs 219 crore in the same period a year ago. Investments from Chennai grew at a faster pace, with inflows rising over 48% to Rs 9.54 crore in 2025, from Rs 6.43 crore last year (Source: Tata MF).

The Tata India Consumer Fund has been a top performer, delivering nearly 20% returns over three years, the best in its category, and 21% over two years, the second-best (Source: Value Research).

Consumption funds delivered double-digit returns of 20.96% in 2024, outperforming the BSE 500 TRI benchmark (15.67%) (Source: Value Research). After a brief dip in 2025, the category has rebounded since March, underpinned by improving macroeconomic conditions. With income tax reliefs, lower GST rates on essentials or processed goods, and rural recovery, consumption is poised to remain key engine a growth in the long term.

The Tata India Consumer Fund follows a forward-looking strategy, with a tilt towards high-growth areas such as consumer services, discretionary retail, durables, and PLI-linked businesses. It consciously avoids highly leveraged or low-margin traditional sectors, while also maintaining diversified exposure to consumer-facing plays in autos, capital goods, building materials, QSRs, and e-commerce.

With structural drivers intact and cyclical factors turning supportive, the fund potentially offers investors an opportunity to participate in India’s next phase of consumption-led growth.

Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purpose only and do not construe to be any investment, legal or taxation advice. Any action taken by you on the basis of the information contained herein is your responsibility alone and Tata Asset Management Pvt. Ltd. will not be liable in any manner for the consequences of such action taken by you. Please consult your Mutual Fund Distributor before investing. The views expressed in this article may not reflect in the scheme portfolios of Tata Mutual Fund. The view expressed are based on the current market scenario and the same is subject to change. There are no guaranteed or assured returns under any of the scheme of Tata mutual Fund.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

It may be noted that risk-o-meter specified above is based on internal assessment. The same shall be updated as per provision no. 17.4.1.i of SEBI Master Circular on Mutual Fund dated 27.06.2024, on Product labelling in mutual fund schemes on ongoing basis.

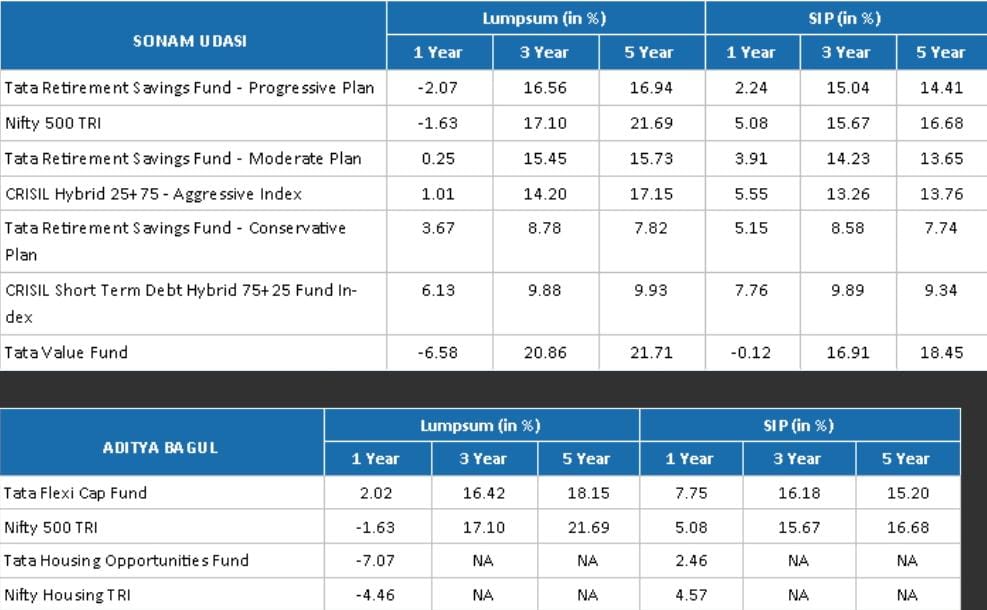

Data as on 31st August 2025

Scheme Performance in SEBI Format